As the economy grows and the crowded loan officer market becomes more competitive, mortgage loan officers have to constantly stay up to date on which marketing and lead generation tools will keep new clients walking through the front door. After all, without new clients, your business and income will evaporate.

But which tools are absolutely critical to your success?

While plenty of marketing tools for mortgage loan officers exist, with these five core tools in your toolbox, you’ll be able to consistently generate leads and close more deals.

1. Personal website

As a mortgage loan officer, your personal website is the most important marketing tool at your disposal. Consider it the heart of your online presence. It acts as the central hub of all your online marketing efforts, allowing you to showcase your services, share your expertise, and gather lead information all in one platform.

Even if you work with a large or national brokerage, having a personal website that you can point potential leads and clients to can help establish a more personal connection and increase your chances of closing a new deal.

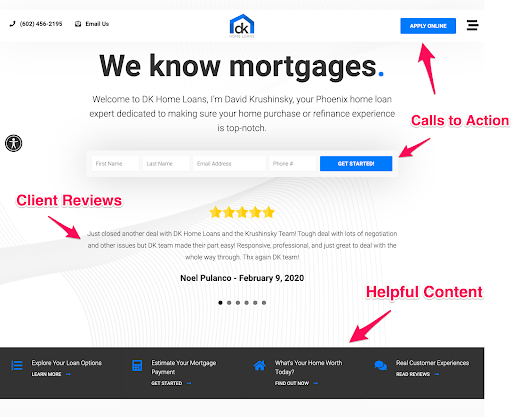

David Krushinsky from DK Home Loans in Arizona uses his agency’s website to build relationships with potential leads and give them the tools they need to learn more and begin the mortgage process.

Source: DK Home Loans

His website uses three critical elements to accomplish this:

Direct calls to action (CTAs)

By using large buttons right up front, he encourages viewers to fill out a simple form to get started on the mortgage loan process and apply online.

Client reviews

Using reviews to leverage positive client experience is a great way to build credibility and trust in the eyes of prospective clients.

Helpful Content

Fifty-eight percent of homebuyers seek budgeting and financial advice from lenders when preparing to purchase a home, so creating and showcasing useful content on his website helps answer questions and prove his expertise as a mortgage loan officer.

For even greater marketing insight, consider using dynamic phone numbers and form tracking to better understand how visitors find your site and get a direct notification when someone fills out a contact form.

2. Google My Business page

A well-crafted Google My Business (GMB) page can bring your mortgage loan business to the top of a Google search result. And quite often, you can do so without having to spend large amounts of time on search engine optimization (SEO). Because GMB pages highlight local businesses, this allows you to show up right alongside (and sometimes even beat) larger or national mortgage brokers that pay top dollar for ad services and SEO in your local area.

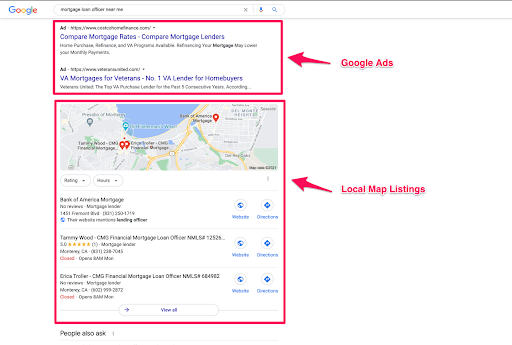

Take a look at this quick Google search for “mortgage loan officer near me.”

Source: Google Search for “mortgage loan officer near me”

After the paid Google Ads listings, Google serves searchers with map listings of local lenders tied to a searcher’s geographic location and believes best match the searcher’s inquiry. The information for these lenders is taken directly from their GMB pages, meaning lenders need to ensure their pages are up to date and optimized to rank higher in local searches.

Once you have your GMB page set up, boost it with these next steps:

- Make sure your business name, address, and phone number are consistent across all your online marketing channels.

- Share your profile listing and ask current and previous clients to leave reviews.

- Regularly update your profile and add new photos – such as happy clients with their new homes – every couple of weeks.

3. Call recording and tracking software

While marketing and communication are undergoing a digital transformation, clients further along the loan process still collectively prefer phone calls and in-person support to meet their needs. Making personal connections with mortgage loan seekers has never been more important. Now, with call recording and call tracking software, these personal interactions can also provide you with valuable customer data that can help you close the deal.

Call recording does more than just help you remember what was said in inbound and outbound phone calls. It turns each phone call into a treasure trove of marketing information and customer insight.

Call recordings can:

- Reveal common questions and pain points that visitors and clients have – giving you material for future marketing campaigns

- Be used as training material for you and/or your sales team

- Ensure quality control on phone conversations

- With Conversation Intelligence,you can automatically identify and flag customers who are further along in the sales process

On the other hand, call tracking helps you see which marketing campaigns and materials are driving the most traffic and interactions to your business.

Imagine you are marketing your mortgage loan business using Google, social media (more on that below), and direct mail. But, as the phone starts to ring more, you can’t tell which of those marketing channels is responsible for increasing in calls. And what if one of your marketing channels is costing you more but attracting lower-quality leads?

Call tracking solves this problem by giving you greater insight into each of your marketing channels. Not only will you see where your highest-quality leads are coming from, but you can also save advertising dollars by cutting back on channels that aren’t converting as well.

4. Facebook business page

While many social media platforms exist, a Facebook page is one of the best marketing tools for mortgage loan officers.

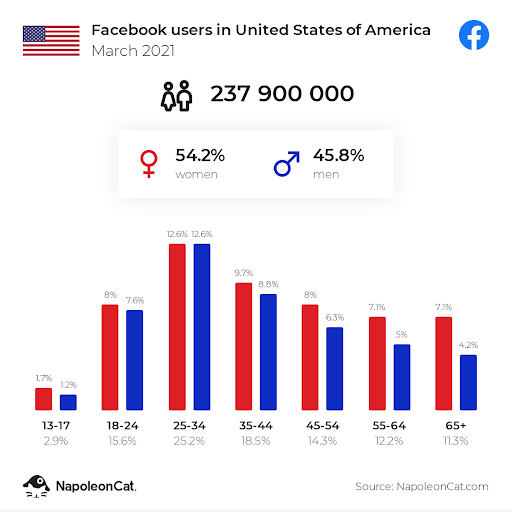

The largest Facebook user group in the United States is between the ages of 25 and 34, perfectly aligning with the average age of first-time homebuyers. And when you factor in that the average American spends roughly 127 minutes per day browsing social media sites like Facebook, it’s clear that loan officers who don’t take advantage of this marketing tool are leaving a lot on the table.

Source: NapoleonCat

Facebook business pages allow you to:

- Showcase your business and your personality.

- Post informative content that helps display your expertise.

- Collect and display client reviews.

- Live stream events and seminars to connect with current and potential clients.

Additionally, having a Facebook business page gives you access to Facebook Advertising, a powerful tool that lets you designate specific audiences (such as young adults moving to a new city) and geographic locations with your mortgage loan ads. Whether you want to increase website traffic or get more potential leads calling your office, Facebook Ads provides multiple advertising options you can tailor to your goals.

5. Referral system

Using a referral system to leverage your interactions and successes with real estate agents/agencies and previous clients is a surefire way to drum up more business and close more deals.

Ninety-three percent of consumers say they trust the recommendations of friends and family more than any other marketing technique. Plus, data shows that people who are referred by friends and family are four times more likely to make a purchase decision.

Setting up a referral system for your mortgage loan business doesn’t have to be hard. Some simple steps you can take to get started are:

- Create a landing page on your website promoting your referral program and clearly state the incentives and rewards available for successful referrals.

- Tell your friends, family, previous clients, and real estate agents/agencies about your new referral program.

- Use social media channels to highlight your referral program, and share stories about those who have benefitted from it.

Additionally, consider using a dedicated referral tool to help you manage and track your referral network.

Make customer experience your top priority

We’ve just listed the five essential marketing tools that you can start using to generate new leads and close more deals for your business. And while it might feel overwhelming, remember: your number one priority is to provide top-notch, positive customer experiences to each and every one of your clients and prospects. By viewing each of these tools as a way to enhance those experiences, you’ll find consistent success for your mortgage loan business – regardless of which tools you decide to use.