Session Transcription

Introduction

I’m Ryan Garrow, I've been in the digital marketing space for about a decade. Was CEO of an organization that Logical Position purchased about 44 and a half years ago. My wife and I owned five businesses. We have four kids between the ages of two and seven and we thankfully live on eight acres just outside Portland and do some farming and growing there but generally across Logical Position, I'm considered just pretty much crazy. Nobody has four kids between two and seven, that's insane but I do and it's fun and we do a lot of activities outside during lockdown.

Today’s Agenda:

- Tale of Two Companies

- Successful Companies

- Goals for Growth

Today we're going to talk about growth in a down economy. Down economies are not exciting. They're not fun, but they provide a tremendous amount of opportunity for brands that want to take advantage of it.

We're going to look at a tale of two companies and pretty much as bad as it gets in the depression. We're going to look at what some successful companies do and what happens to them and then we're going to look at how you set goals for growth, at least in online marketing and how you can hopefully overcome some competitors in this time period and leverage what's going on in our economy to your benefit.

History of down economies in the US

Looking back, we've had 47 recessions in the United States in 1776, and in the last 100 years, we've had 18. More than likely we're in 19, it's not official yet. We're keeping about the same cadence of recession that we've had for 250 years. It's not accelerating or decelerating, but what we are doing better at is coming out of them.

In fact, the average recession has gone from about five years to around two and a half, three years over the last 100 so it's continually getting better. We're learning more from recessions and what we can do to stimulate our new economy to come back out of it. A lot of truth through trial and error, every recession is different because for different reasons, but some good news there.

A Tale of Two Companies: Ford vs. Chrysler

I want to touch on some things that happened in the Great Depression. As bad as it's gotten in the U.S. in what we pay attention to, we've had some pretty bad recessions throughout the last 250 years but in the Great Depression, we had two very different organizations. Their approach to the depression was very different. They were very similar. They were car companies, Ford and Chrysler.

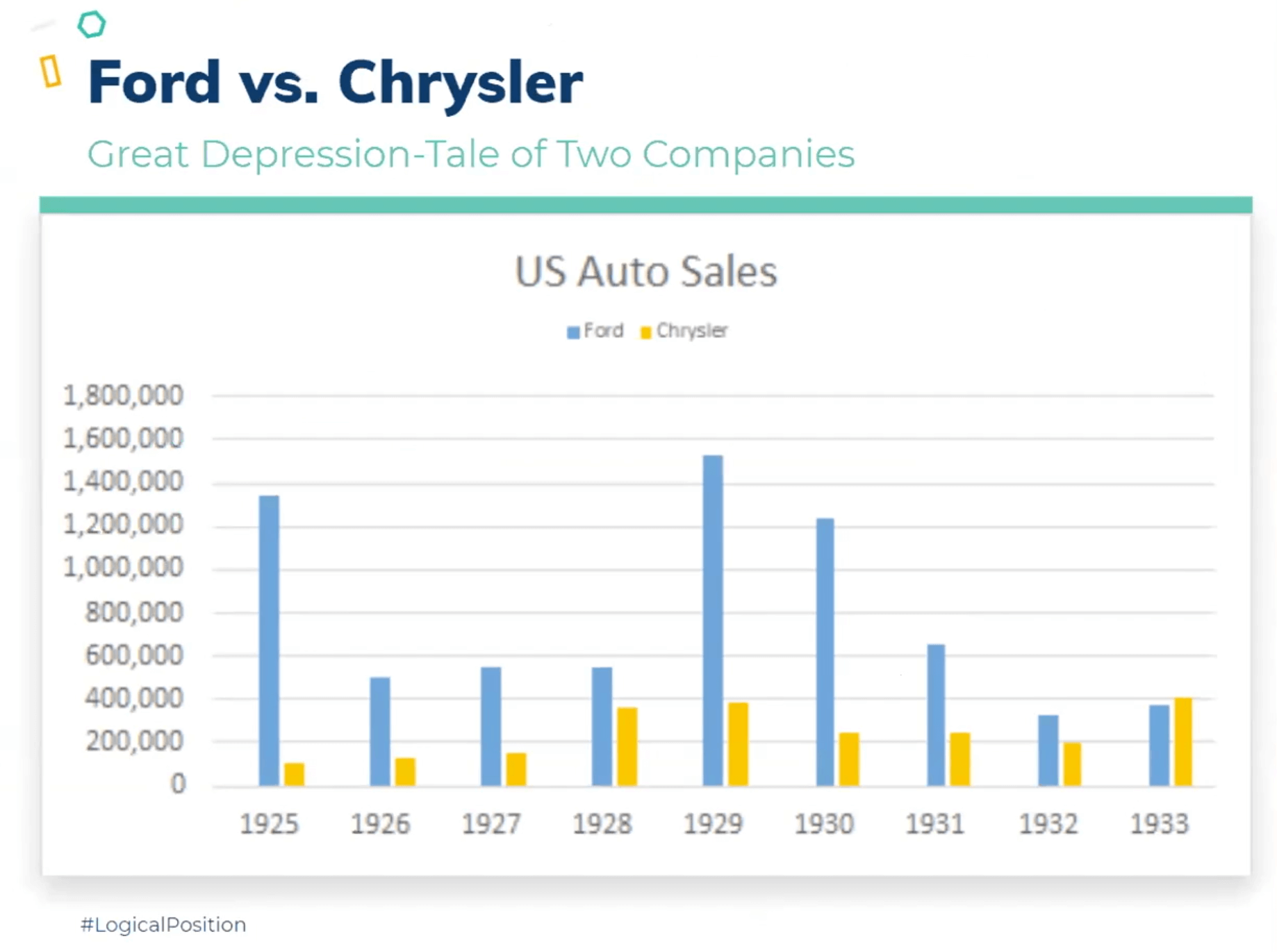

If you look at this graph, you'll see the blue line is Ford and their sales volume. The dip there between 1926, 1929 was actually then retooling their supply chain and all of their manufacturing facilities for the Model A release. In 1929, Ford sold one car in one color. It was black. Hope you wanted it, Model T. It accounted for almost 50% of all auto sales before 1926. Henry Ford for all intensive purposes was an Amazon of the auto world in pre-depression times so we're in the roaring '20s.

Funny enough, the 1920s was right after the Spanish flu epidemic in 1918. We were in a recession. The Spanish flu sent us worse so coming out of that the auto industry exploded and it was the roaring '20s, so a lot of great things happened. Unfortunately, coming out of a recession led into a depression, but there's always ups and there's downs. What you'll notice about this is Ford's absolute domination through this program. Then the Great Depression hit. Black Monday was in October 1929.

By 1933 Chrysler as an organization outpaced Ford sales. In fact, Ford didn't reach their pre depression sales until the 1950s. That's how long it took for them to come out of the depression and they had a massive lead.

Different Approaches

At the beginning of the depression in 1930, Ford had $40 million of profit. They were hugely profitable in the release of the Model A. From 1932 to 1933, they actually had lost $88 million. It wasn't an inconsequential number to Ford. They had massive layoffs across their supply chain.

Henry Ford, in all of his innovations at creating a phenomenal manufacturing supply chain and ability to use the assembly line he vertically integrated, which was great for controlling all of the suppliers but when things go bad, owning the entire chain means all of these things you're having to grind to a halt, and then it just becomes very messy and difficult in a downturn.

They cut most of their advertising at the time (think radio, newspaper, etc.). This actually worked to the benefit of Chrysler who at the beginning of the downturn rate, focused on low prices with their Plymouth brand. They felt they had a niche there that they wanted to attack. With GM Cadillac, they were at the higher level. They felt they had an opportunity with Plymouth.

Chrysler and innovation

Chrysler innovated aggressively through the Great Depression. They knew through the new deal that they were building highways, all of the great works projects, WPA. By building all these new highways, new people are going to need faster and more powerful cars. They really invested in developing their larger engines which was part of the Dodge Brothers they acquired in 1927.

Walter Chrysler was actually famous for saying, I don't care how bad things get. I will never take one penny out of the research and development budget.

He knew he had to continue evolving and developing his product to stay ahead of the competition and have a product that people wanted. Chrysler also got into marketing pretty aggressively. While Ford and GM were in the process of cutting back their dealers and getting the cars out to people, Chrysler had a lot of people that knew how to sell cars that no longer had cars to sell. That was to their advantage. As Ford left radio and newspaper, it left a lot of vacant inventory that needed to be filled and Chrysler was able to negotiate some pretty decent rates on filling that inventory.

Walter Chrysler also hated debt. In the middle of the depression and while still growing, he actually paid off all of their debt by 1935. While everybody else was going into debt to try and mitigate things, they were spending money in marketing. They were aggressively expanding into new dealers and truly doing the opposite of what a lot of other businesses do when things get bad to kind of batten down the hatches.

Outside of that, you have two studies that were done more recently over the last 30, 40, 50 years over depressions and recessions that happened in the U.S.

The 70’s

Between 1974 and1975, they interviewed 143 companies and the ones that continued marketing through the depression at the highest growth rates, not only in the recession but in the two years that followed the recession. They had to continue advertising and marketing even though they didn't have all of the advantages that we now have to be able to track all the marketing. They only knew that they had to continue to invest in advertising, billboards, TV, radio, magazines, newspapers, and anything else they could utilize in the '70s.

The 80’s

From 1980 to 1985, 600 B2B companies were investigated and analyzed and they had a 256% average increase from advertisers to non advertisers through the recession. If I haven't told you anything, you need to keep marketing. Now, what we're going to talk through to a degree in a second is how you align that with what you're trying to accomplish as a business. The other thing I wanted to look at and kind of set the stage, not only can big things happen in a recession in a depression, but if you look at the Fortune 500, that's kind of like me growing up as a kid. I looked at GE and really idolized Jack Welch, being a kid from the '80s and '90s.

If a company as big and as vast as GE that covered so many different industries and was supposedly recession proof can crumble so quickly, I think it can happen to almost anybody.

Fortune 500

In 65 years, you had 88% of the largest companies in the world go bankrupt, get acquired, or failed to keep growing. That is an astounding number. They have more resources than any of their competitors. They have the ability to hire the best people and yet these companies are failing at staying relevant and staying large probably through two generations of leadership.

S&P 500

The average time you spent on the S&P 500 in 1965 was 33 years. They expect by 2026, that's only going to be 14 years. You're going to say you're going to go from nothing to top 500 companies to below 500, again, in 14 years. That's mind boggling to say the companies that we know now as the largest companies that we respect will not be there on average in 10 to 15 years. This means we have a huge opportunity and for me, a lot of that comes from digital marketing.

Online business

Step one, align the channels that you have to move levers on. At Logical Position, we primarily focus on the traffic generation. Jeremy is over on the email retention side in his division, which is a relatively new one for us, then in the middle, you have the website itself. You can improve the conversion rate by maybe giving discounts.

If I give everybody that comes to your site, a 90% discount, you're going to get more sales, but you also gave up 90% of your revenue. Even just ranking higher based on the platform you choose or the speed that it is, you can use apps. Earlier today, I talked on a webinar for Bolt and they're a great app to help increase your conversion rate. CallRail can help you track phone calls and get revenue even tied back to a phone call, which can be hugely valuable to help drive the right types of traffic. You just have to conceptually understand this.

I'll walk business owners through the following mindset: We have to be able to drive the right traffic that will convert. Once you get them, you have to make sure they come back to you and they like you and they want to spend more money with you after the fact. Start here, understand all of these, and then you can go into how do you set goals on the traffic you're driving to the site?

Paid search goals

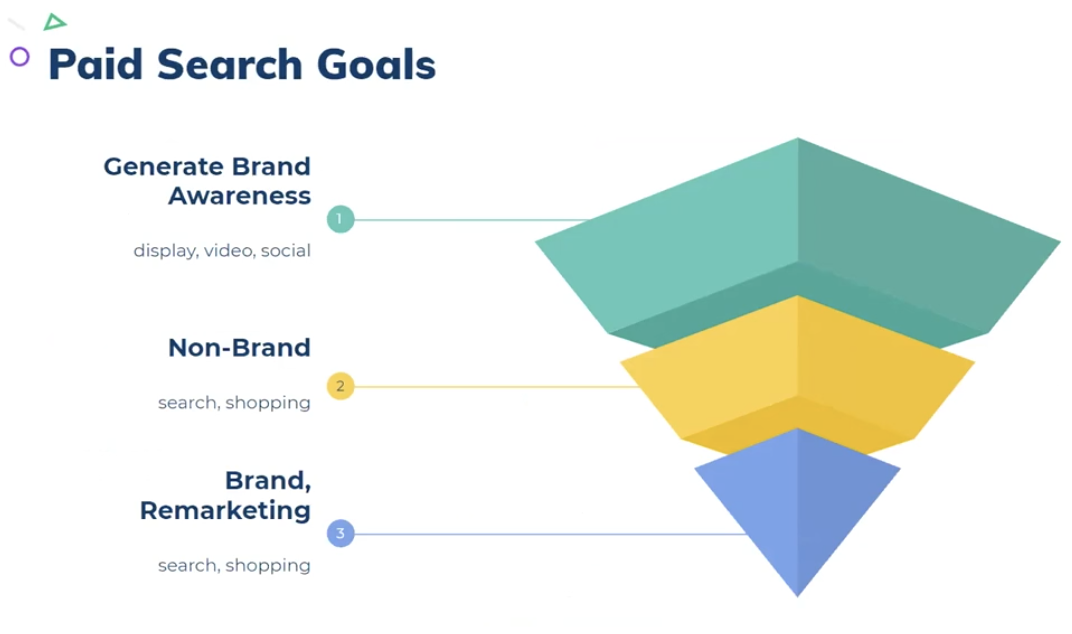

- At the bottom of the funnel, people are ready to buy right now.

- At the top of the funnel, people may just be hearing about your business.

Paid search can play a part through the entire funnel while slowly coaxing users down the path to conversion. As you continue to push people down the funnel or capture people further down, your return on ad spend is going to get higher. It's generally lower ad spend at the top, higher return on ad spend on the bottom.

For most brands that are starting out, I recommend starting at the bottom and branch out. Cover the stuff that is easiest to capture. This will help you know what people are searching for that are causing them to convert at a very high rate.

In most cases, conversions are on an attribution path that looks like a bowl of spaghetti. There are people, like myself, whose conversion path is very linear and simplistic.They see, they click, and they buy. Most other users, like my wife for example, are a bowl of spaghetti. They’re going to be all over it, but they’re going to hit a meatball on the way by. They search on their computer and later switch to look on another device, then then going to come back. They may have been researching their need for months, following discussion threads, comparing products, etc. There's probably no company on the planet that my wife has spent money with in the past two years that has any idea how she found them. It doesn't exist.

The majority of people are closer to the plate of spaghetti in how they're buying from your brand, and so understanding the funnel, understanding the plate of spaghetti, it sets a good foundation that you're not going to be able to track everything. Know that it’s imperfect and track what you can and set goals around what you can see.

Paid search business example

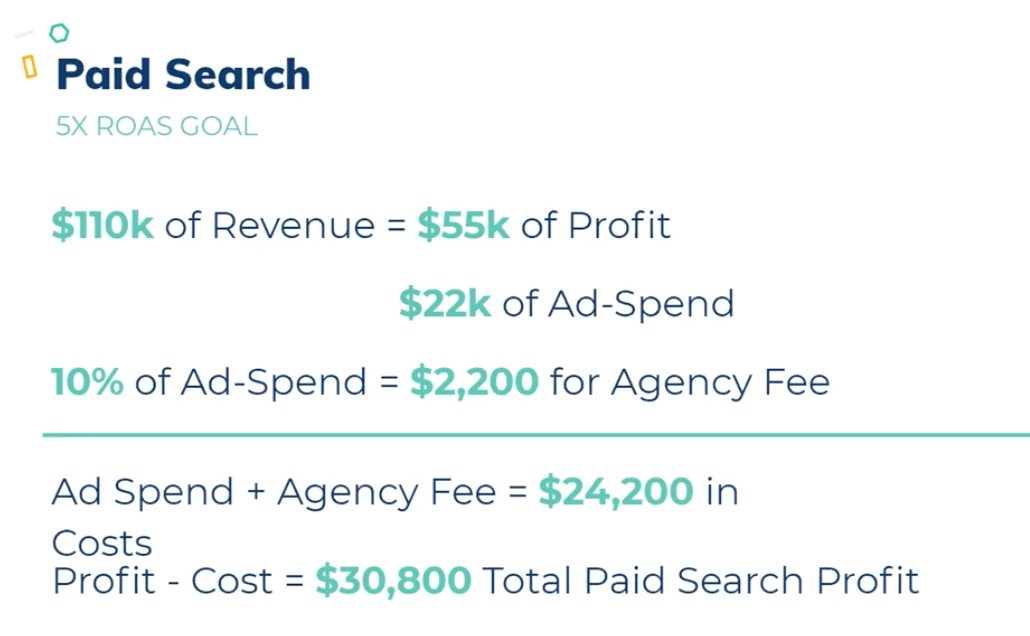

A business owner tells me they have a 50% margin and for profit, sets a goal for a 5x return. For every spent online, they want $5 in revenue back. They’ve been able to accomplish this in the past, so why not now? Last year, they did $100,000 in revenue and they want to grow at a rate of 10%

- $100,000 of Revenue x 10% = $110k

- $20,000 of Ad Spend + 10% = $22k

They’ve turned $22,000 of ad span into $110,000 of revenue and are a money printing machine. The business owner is happy with the goals and wants to do it all over again. They're never satisfied.

That goal of 5X of that business owner did not hit the goal that they were trying to accomplish more than likely.

Brand and Non-Brand: Profit Now vs. Later

You first have to decide as a business owner, do you want profit now or do you want profit later? It's not that you can't accomplish both, but from the page search or traffic generation side of things, those goals are not the same thing you shoot for at the same time.

- Brand: Users who know who you are and are much closer to buying.

- Non-Brand: Users who are in the market for your product or services, but may not know who you are yet.

You really get to set your goals around non-brand. Your brand is going to be profitable almost all of the time. Your brand name, especially in an e-commerce realm, you can have a lot of profit around that and your profit is not something you can necessarily control on your brand. It's going to be dependent on a few things:

- Google and how they're showing search results. Sometimes they're going to show text ads above the organic. Sometimes they'll show review stars. Sometimes they'll show shopping ads above the text ads and above the organic.

- Competitors jumping in on your Brand terms for a few hours a day.

Eliminate that knowing it's going to be profitable and make sure you have very clean data in your Google Ads or Microsoft Ads account so you can track the profit on that and track the overall spend.

We're setting our goals on non-brand because non-brand people generally are not customers of yours in the past and that’s going to help you grow your company.

Profit now: Non-Brand business example

Let's play this out. Again, we're going to stay with the same company. They have a 50% margin on products and want profit now. The business owner retail storefront isn’t being used, but they need to cover the rent for the property. It's not an option to not have profitable Google ads or Microsoft ads. Let’s focus on non-brand.

Now, the goal from the business owner was to create profit. If you actually lowered your goal and didn't hold tight to that 5X goal, generally you're going to get more revenue when you lower your return on ad spend because you can push harder. You can spend more and attract more clicks and more buyers. All this example's trying to show is that the potential is not necessarily in setting a return on ad spend goal you know will drive profit, it's about profit maximization and so you have to look at your ads account and the way you optimize a little bit differently if you want to maximize profit.

It could be that at 4X, you could've spent 500,000 for $2 million. There's a lot of elasticity in these things depending on the industry, depending on your competitors, depending how big your market is, that there's a lot of variables that go into play. As a business owner, don't get stuck on a return on ad spend goal because you got it in the past. Let's look at the market changing. Google is changing their SERP pages.

Profit later: Non-Brand business example

This is where I put most of my brands. I'd rather grow a large massive company and take most of my profits later in the game. Paid search specifically is a not profit game. Overall my paid search is profitable, but my non-brand is breakeven.

With a 50% margin company, I set a goal of 2X, so I'm spending 200,000 for 400,000. I'm not making profit on the first order, but I know I have a high lifetime value of a customer, therefore I'm comfortable doing that, and so I'm getting new customers that aren't going to my competitors. I get email. That's why email marketing is so important in this game, future profits from order.

That email for future profits and future orders is highly important. If you don't have that, it's very difficult to push the lever down to break even on that first customer acquisition. Some companies know their email is so dialed in, they can predict that this customer will come back and buy two times over the next 18 months, almost guaranteed, therefore they're willing to get more aggressive and we have some clients actually lose money on the first order on purpose.

Yes, you're not going to get your profit day one on that order but there are some perks:

- You get that customer over your competitor.

- Halo effect: The more you spend on Google Shopping, the more people end up on your email list, the more people find you organically, the more your direct traffic grows.

This opens your attribution path. More people find you on shopping and then go do more research and then come back to you through another channel and purchase. There's a lot of these people with plates of spaghetti attribution that you're never going to see the exact last non-direct click attribution in Google Analytics, but you are going to see the organic traffic increase and so it's a great report.

If you haven't seen it Google Analytics called assisted conversions. If you label your shopping campaigns appropriately and you can segment them out in a brand, non-brand, you will see non-brand shopping driving a lot more revenue in assisted conversions than it does in the last click conversions and you can start to see where that shopping campaign is popping up and helping other channels convert.

Paid search summary:

- Stay the course: Advertise

- Big now doesn't guarantee that you're going to be big later and successful later

- There's opportunity for people that are small and want to become a big company

- Make sure your paid search acquisition goals are in line

- Profit max NOW or profit max LATER

For all businesses pushing through COVID-19, you need to focus on trackable dollar and the return on ad spend. Thank you.

Q&A

1. What have you found to be the best approach to get shoppers to return to you for buying after looking at competitors?

Start doing remarketing. Also, you need to be building audiences in your Google ads account. If you've got a bunch of people that have clicked on an ad and didn't buy, you want to create that audience so you can either do one of two things. Either bid more aggressively or turn off bidding altogether then come back and search because you need to have the data to say, all right, this user found me on this term. Didn't buy. If I catch them again in the research process, they come back and buy at a rate that makes sense to you, get more aggressive.

2. How do you own a brand if you sell a service that's relatively newly being offered in your city and do you set a price higher or lower than your competitors?

I've had this question about somebody that was doing roof treatments in a new way and you had to generally get more aggressive because you had to educate people. This is where YouTube became more powerful as far as an education. You can create some creative custom audiences. You can use some of Google's intent audiences in market segments

There's a lot you can do there but with pricing specifically, I would recommend getting aggressive because you want the customer and then focus on how you build future profits out of that because if your competitors aren't as comfortable lowering their price, you're going to get a massive advantage.

3. Do you have any tips for a community bank on the best way to grow a customer base with online marketing?

Yes. I've been talking to a lot of credit unions actually right now. Google has created interest segments or intent segments within Google. They know everybody in an area that is right now looking for a checking account, an auto loan, or a mortgage. There's one area you can be advertising for. You can use display ads if the clicks for the search are heavy because the big banks (Bank of America, Chase, Wells Fargo) are going to be aggressive on somebody looking for a checking account on Google. If you can compete with them a little bit, head to head on some of those click costs, great. Do it.

Digital Marketing Boot Camp | Logical Position:

- Session 1: Adapt Paid Social Strategy During COVID-19 | Emma Huschka

- Session 2: Integrating CallRail with Google Ads: The Do's & Don'ts | Josh White

- Session 3: Optimizing Call Tracking| Tim Benson

- Session 4: Conversion Rate Optimization: Website Audit | Jon MacDonald

- Session 5: Importance of Email Marketing | Jeremy Vale

- Session 6: How To Grow In A Down Economy | Ryan Garrow