Video Transcription:

I’m Noah Freeman, one of the Social Fulcrum co-founders and I run the performance, R&D, and software teams. Our company is the largest Facebook and Instagram-only boutique agency in the world (we think!) and we have a 25-person strong team based out of Boston. I’d classify us as an ad-optimization and measurement company that masquerades as an agency — we’re a pretty data-obsessed bunch. Most of our business is in the eCommerce space and on large retail projects, so as you can imagine, that means that a large chunk of our business is fairly quiet right now.

Today’s Agenda:

- Ad performance overview

- Strategies to boost Facebook Ads performance

- Q&A

I want to go through two things. First, I have about five slides that run through our clients’ average Ads performance over the past six weeks — I think it’s really useful for people to look at specific metrics like CPMs, conversion rates, and things like that. Secondly, we’ll take a more strategic look at how you can boost your Facebook Ads performance in the current climate.

Ad performance overview

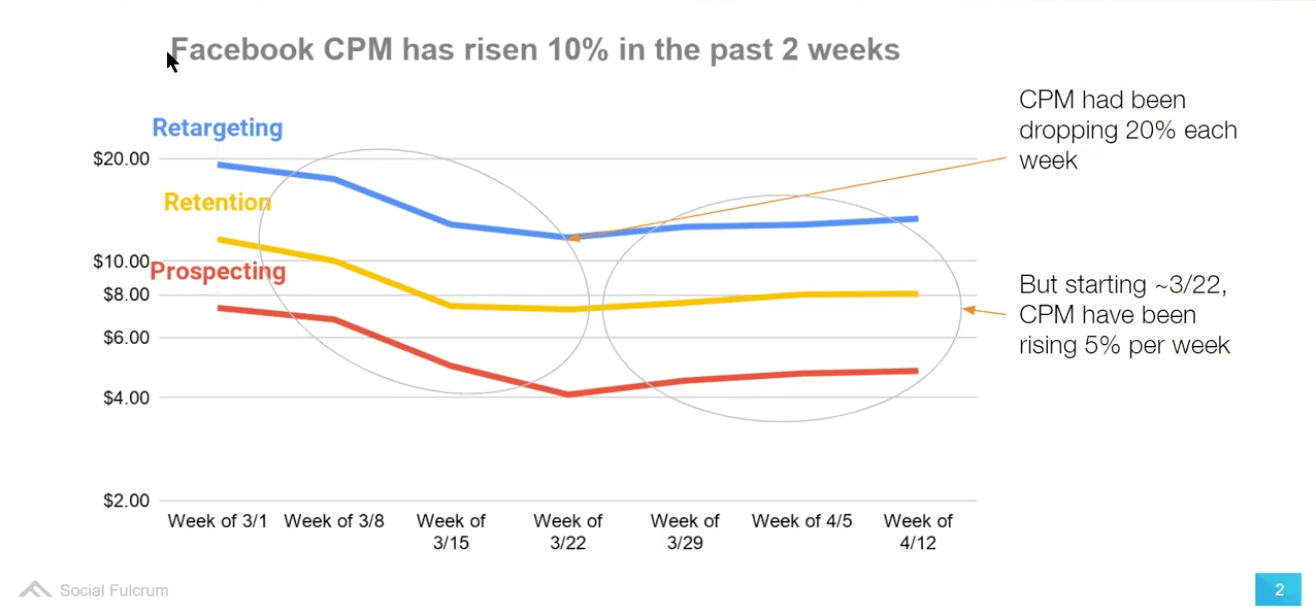

I’ve been hearing lots of people say “What’s going on with CMPs?” recently, so I think it’s worth delving into this in more detail. There are basically two blocks of time that we need to think about:

- The first three weeks of March when the crisis was unfolding

- The five weeks since when the crisis was already kind of established

CPM

During that first period, there was a massive drop in CPMs by around 40%, though this obviously depended largely on the campaign type.

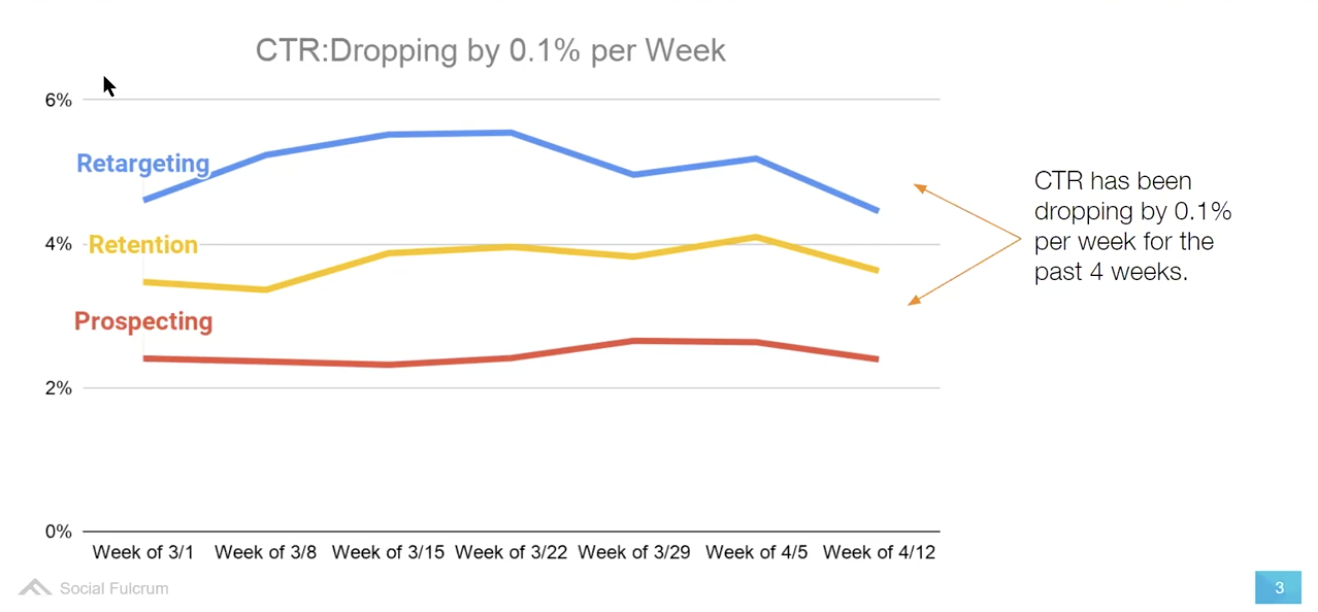

CTR

From March 1st to about March 20th click through rates actually rose. This was really unexpected, because it was hardly a time that was marked by a ton of success in E-comm for most people.

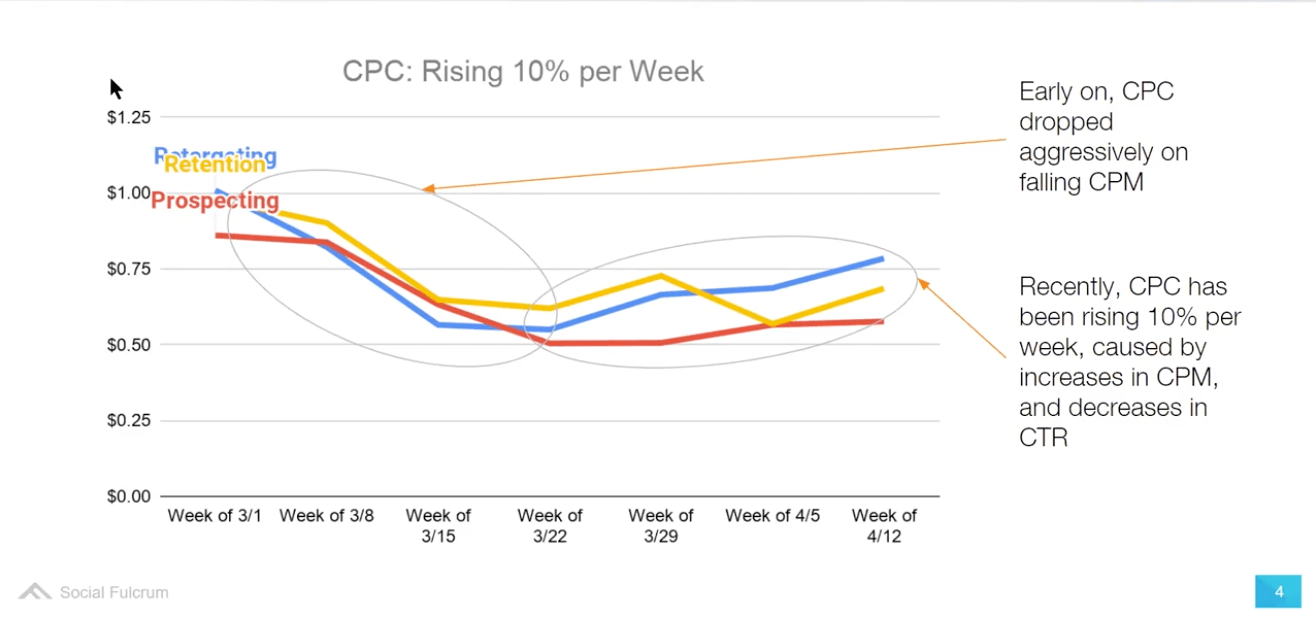

CPC

If you have CPM and CTR, you can calculate CPC and what you're seeing is there was a large drop in CPC, almost 50% drop in CPC across all campaign types in the early March as we saw a lot of what we're calling this “browsey” behavior. People were clicking on ads.

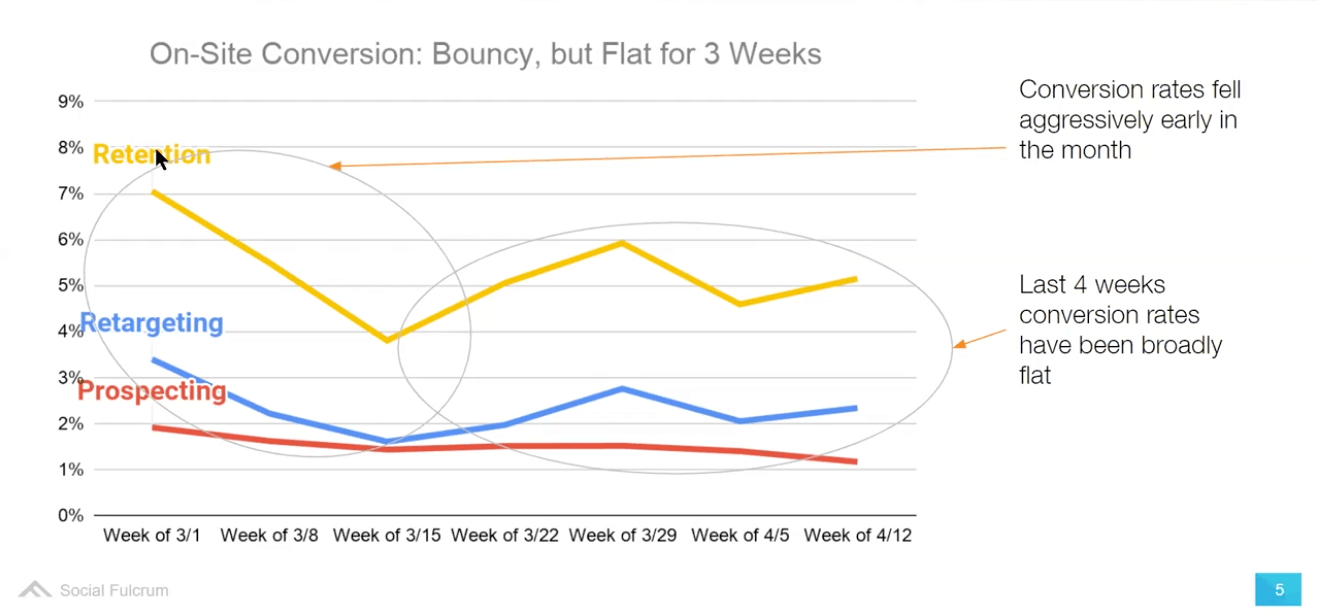

Conversion Rates

But why that was really interesting is the huge drop in CPCs, which you saw back here was offset by almost an exactly identical drop in conversion rates, right? In early March when people were being really browsey, they were clicking on ads, but once they got to the sites, they weren't converting. We saw about almost a 50% drop in retention conversion rates and about a 30% drop in prospecting retention rates. Then what we've been seeing now is that that is bouncy and flat. Retention's recovering a little bit. Prospecting's dropping off a little bit. But overall we're now in a flat conversion environment.

Costs are up

Costs right now are generally flat or on the up, depending on the campaign type: prospecting costs are rising pretty sharply, retention is getting meaningfully cheaper, and retargeting is fairly flattish. There are a few interesting things to note here. First, we had this period that we’re calling the “prospecting honeymoon” in the second half of March where prospecting was cheaper than it was pre-COVID, which we found strange. This was due to a combination of CPMs dropping while CTRs drastically increased.

At this time we basically asked our clients to aggressively shift their focus into prospecting. This was quite controversial — there was mass disruption and widespread panic but we were asking companies to pour their money into new customer prospecting. But if you looked at the data, it all made sense.

Summary of changes

- CPM rising ~5% per week

- CTR dropping 0.1% per week

- CPC rising 10% per week

- Conversion rates are flat

- Cost per Purchase are up 15%

Facebook Ad Strategies

Tip 1: Focus geographic spend on low cost, low spend cities

Facebook's current geographic spend allocator is broken. Normally you can launch a national campaign, and it will allocate spend by city pretty reasonably and give you similar costs, but right now it's not. What we're seeing is that campaigns will have very low cost cities that don't get much spend, which shouldn't be happening.

What you can do to fix that breakage is by launching an extra campaign for your underserved geos. Find the geographies that have unusually low cost but also low spend and launched them as a parallel campaign. You have your general campaign and then you have your underserved geography campaign and maybe Austin, Texas is in both of them, but New York is only in the general campaign, not the underserved geo campaign.

Tip 2: Start to re-allocate campaign budgets back towards retargeting & retention

Another thing is the data that your performance by campaign varies really aggressively right now and the week to week is very different. Whatever the allocation of budget you had between campaigns in February is now wrong. Arguably the one you had last week is also wrong.

Be quick to respond to changes in campaign performance and reallocate money. I'm not saying you should or shouldn't be spending more on prospecting, but whatever you did a month ago is not right now, and you should really be carefully thinking about what your budget is at the campaign level to take advantage of this. Another side note is unless you're a weird retailer who's open right now, you should have CBO turned on, because it's doing a very good job helping people identify good audiences quickly.

Tip 3: Test creative that focuses on speed & delivery visuals

We've seen some creative that worked really well, that really focused on delivery. Boxes on doorsteps seem to be doing very, very well and we've been using a lot of copy and testing that says, "Ships in 48 hours. Ships from the U.S." doing really well as well. You normally think of E-comm campaigns as focusing on cardboard boxes. You normally focus on products, but they're working right now.

Tip 4: Test large lookalike audiences

You should also expand what you think of as your top audiences, because every account we're working on right now, the audiences that are working today are not the audiences that worked two months ago. Testing a lot more audiences, but also think about using really big lookalikes. What we're seeing is that these big lookalikes, may be capturing it maybe that your best customers aren't the closest lookalikes of your recent customers. There's sort of a general lookalike and then we can find them again. We've been doing big lookalikes, and those have been working very well.

When you build lookalikes, you can specify how long the seed is like, "Oh, is it seven day add to cart? Is it 30 day add to carts?" and making sure that all the lookalikes you're running are using very short windows. You don't want to do is say, "Oh, I'm going to lookalike 90 days of customers," because half of those are pre-COVID. You want to be lookaliking the last 10 days of customers, the last five days of customers.

Q&A

1. You were talking about some of the underserved geos and the parallel audiences and things like that. Why do you think those are performing?

Yeah, I think what's happening is Facebook is using an out-of-date allocation by cities. And that if they use a pre-COVID distribution and they say that X percent of spend should go to New York and New York is locked down, then that allocation is wrong. I think the core issue.

One thing we're seeing on geo that's really interesting is the underserved geo list across clients is very different. And what you see is for some accounts the geos that need help are the most locked down geos, and in other accounts the geos that need the most help are the least locked down geos. It's not that New York is consistently underserved or overserved, it seems to vary by account.

2. What do you think about switching to a brand awareness strategy while conversions are low?

I think that's a really attractive idea. I wouldn't necessarily say brand awareness. We are a TR centric agency, but I would say thinking about upper funnel strategy. That would include brand and awareness, but I'd also think of them as product view and video view campaigns, right? You could do brand awareness, which is my least favorite of those three. Another thing you can do is taking advantage of these low CPMs. You can run product view campaigns and then retarget those audiences later. You can run video view campaigns and retarget the video viewers later.

That would be a cheap time to build up those audiences. Remember Facebook pixels are active for 180 days, so you could build these audiences up now at a 30% discount to normal pricing. Then assuming we're back to business inside the 180 day window, you can harvest them later. That's very much a tactic we're suggesting to clients. I wouldn't think of doing brand awareness. I think you'll be doing video view and product view campaigns. Another thing you could do here would be email capture.

3. On the line graphs that you were showing in your presentation, do you have a breakdown between product-based and service-based businesses?

Yeah, we are. Our client base is dominated by product companies. I would just say to a first approximation, these are all products, right?

We basically focus on E-comm. Well, I mean we focused on E-comm and retail, but none of this data is retail. This is all E-comm clients. I can't think of a single service company in our portfolio. Basically these are all products to a first approximation.

4. What do you think is more important to focus on right now retention or retargeting? Or where should we place a majority of our focus?

I think I would say I would give this answer with or without COVID. Which is you need to have a really strong sense of what the LTV of your customer is and how much you're willing to pay. Once you know that you can figure out what the ROI of your various campaigns are. And my answer always is, "Figure out what the ROI of each campaign is and then move the money to the high ROI campaigns." So right now, I don't necessarily think that retargeting or retention... I mean if you look at costs, retention is marginally closer to its normal performance that retargeting is. That might argue that on average people are shifting to retention. You'd really have to look at that campaign. At the campaign level results make that decision. It's hard to make a blanket statement about that right now. Wait, three weeks ago I would have said, "Whatever you're doing, do more prospecting." Now it's a bit more nuanced.

5. What do you think is the best way to mix COVID messaging into campaigns while still maintaining a strong sales presence without being offensive, drowning the customers in offers? We've all started getting those emails of helping you through and all those people have started marketing again. So what's your recommendation there?

We've done a lot of testing on COVID messaging and what we found is that specifically using the word COVID or the word virus test very poorly. What tests very well is calling out what features of your product are relevant in COVID, meaning... "The virus is really bad. You want fast shipping," doesn't work. But saying, "48 hours shipping to anywhere in the U.S." Or, "Ship safe and secure from the U.S." Or, "Everything currently in stock or still shipping." What's working really well right now is thinking about what your value prop is and how that's changed and emphasizing that.

For example, you might think of this at one account you're working on as being a high price point, high quality account. Quality isn't a good feature right now. No one gives a crap about quality in this current environment, but maybe a minor benefit is they're really fast at shipping. But that's the thing you could emphasize right now. The first thing I'd say is, "Don't talk about COVID by name. Second is emphasize the benefits that are relevant to a COVID environment."

The third thing we've seen is we've tested a lot of different promo types. Site-wide promos are going brilliantly, but the moment a promo has any complexity to it, it doesn't do well. We've had clients do 20% off site wide and transform their businesses. If you try and do 20% off purchases above a hundred dollars as long as there's an address in the basket, zero lift.

6. Do you have something that's worked for the marketing for your company, Social Fulcrum, in terms of any kind of retargeting that y'all are doing or email capture that you're doing as a semi-agency?

Right now, everyone is writing these blog posts that say the same inane generalisms. What we're actually doing is we're putting out this material every week, and I think we've gotten 250 signups to our R&D email list specifically for these presentations. We have been focused on putting forward a data first message, which seems to really be resonating in a bit of a data vacuum right now. We've had four leads who came in through some version of this presentation, either in sign or almost be done with signing in the last four weeks.

One thing we've seen is during turbulent times, thought leadership market share is easy to shift, right? It might take you a year or two to build a following on a normal time, but the same message if it's really spot on and during a crisis you can get that following in a month. We've actually found that there has been a big payoff to the investment we've been making in thought marketing simply because the crisis has just thrown everything up in the air. We have a much bigger following six weeks into this then we would otherwise, simply because not that many other people are publishing stuff like this right now. It feels like mental market share is easier to gain now then normally. Conversely, it's probably easier to lose normal now than normally as well if you're producing that schmuck. We are publishing this data weekly. My email is noah@socialfulcrum.com. Email me and we will add you to our email list and you can get all of these graphs every week.

Agency Expert Q&A Schedule:

- Session 1: Helping Brick-and-Mortar Businesses Temporarily Pivot To E-Commerce | Tony Lael

- Session 2: Managing Through The Crisis: Facebook Ads Strategies for Turbulent Times | Noah Freeman

- Session 3: Free Money from Google & What To Do With It | Ryan Garrow

- Session 4: How Agencies Can Build Additional Revenue Streams | Alex Glenn