Bankrate surveyed over 2,600 U.S. adults to ask why they stayed with their current bank or credit union. They found that for many people, “apathy appears as the basis for why they signed up and are hanging on to their bank accounts. ‘Merger,’ ‘inertia,’ ‘my parents signed me up as a kid,’ were among the written responses” to their survey.

On average, customers keep their checking accounts for more than a decade. A lot will change in their lives in that time. If a financial institution can become a trusted resource for its customers during that period and help them build up their financial literacy and financial confidence over time, it will lay the foundation for long-term customer relationships. And the first place to start is with educational, financial content.

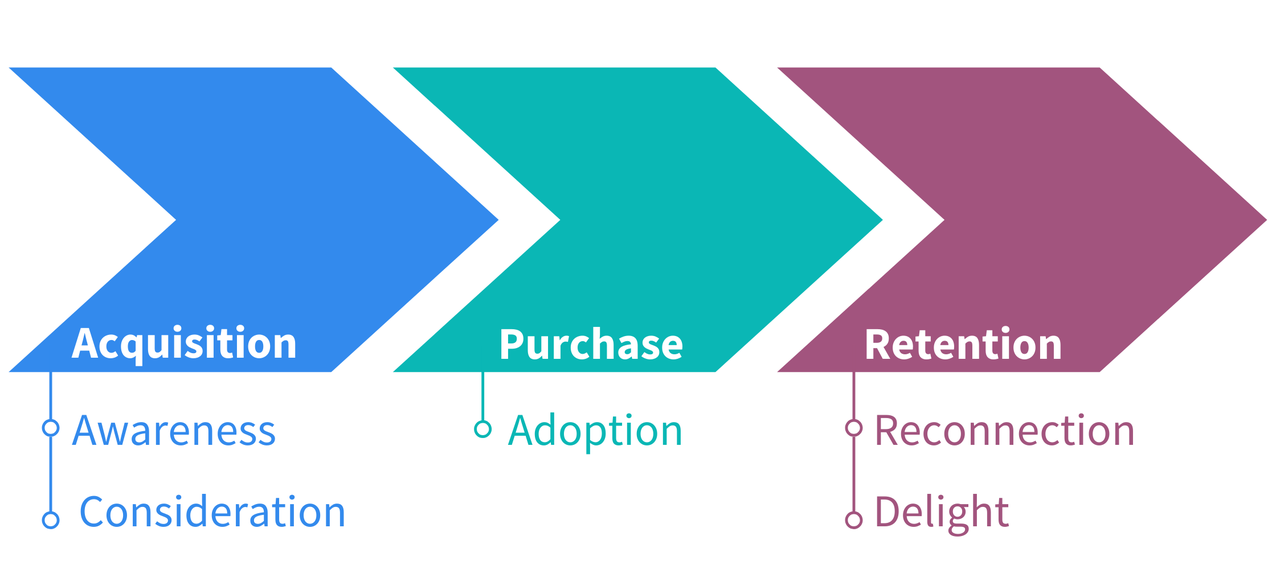

Map out the customer journey to show how customer needs change over time

A customer journey map is a visual representation of the different interactions that customers have with your company. You can map out the key milestones in the customer journey to understand what information your customers need at each stage of the customer lifecycle and what financial content you need to create to meet those needs.

Before getting started, you may want to look at your CRM software or CRM system to gather insights from your customer's typical buying behavior before they make a decision. With those data points on hand, you can start creating a customer journey map by identifying the different touchpoints in the customer lifecycle, such as:

- Visits to your website, including product pages, product comparisons, and help center articles

- Engagements with your company on social media

- Phone calls to account managers or support teams

You can then analyze that data to understand the triggers - what makes customers contact you or visit your website? What’s changed in their life that prompts them to get in touch with their bank or financial institution?

Bonus tip: When building your customer journey map, think about how you can enhance the customer experience across the different phases of customer's buying journey.

Focus on customer lifecycle stages after acquisition to build long-term customer relationships

Many customer journey maps focus on the acquisition stage of the customer lifecycle — the steps they take before they become a customer. But customers tend to stay with their financial institution for a long time, so you should focus on the later stages of the customer journey: retention, reconnection, and delight.

Retention: At this stage, you want to keep existing customers engaged and happy so they don’t look elsewhere for their next financial product or service. Helpful resources such as personal finance guides, money management podcasts, and educational webinars are a great way for financial institutions to use educational content to improve customer retention.

Reconnection: These customers have disengaged with your company. They are not using their accounts as frequently and rarely check their account balance. While there are many possible reasons for this, it may be that they have low financial literacy or struggle to manage their personal finances. Content that tackles common financial challenges such as debt and emergency support may be helpful, along with help center articles and customer support resources.

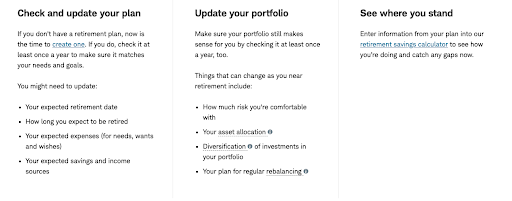

Delight: Hopefully, you’re able to reconnect with your disengaged customers and turn them back into happy customers who may become advocates for your company. For a delighted, loyal customer, you can share content that relates to their long-term financial goals, such as retirement calculators and financial planning tips, to set them up for financial success.

Charles Schwab dedicates a section of its website to planning for retirement to help customers with long-term financial planning.

Create financial content for each major life milestone

Your customers aren’t financial experts, so you can join them in their financial literacy journey and build customer loyalty by providing them with the right financial content at major life milestones. These can include:

- Going to college

- Getting married

- Having a baby

- Buying a car

- Buying a house

- Saving for retirement

Each of these milestones can be intimidating. Offer educational content around personal finance and financial literacy to help your customers feel more confident about their financial decisions. Give them the information they need to keep them from having to look elsewhere.

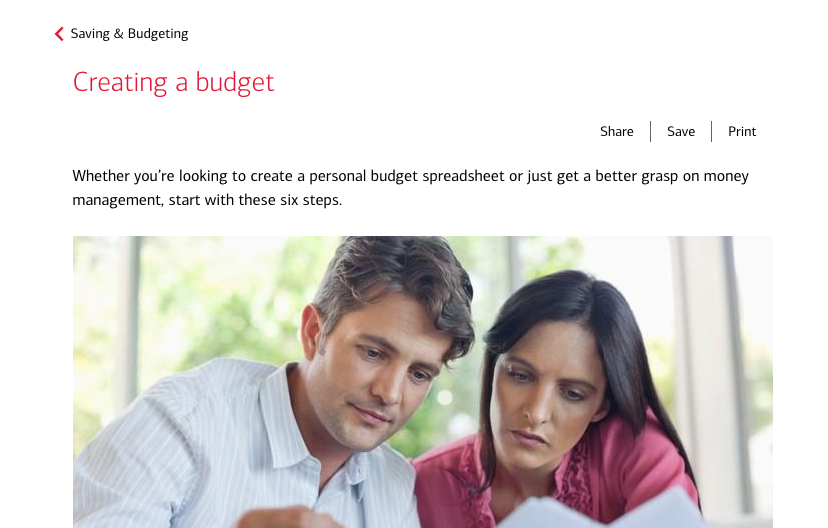

For example, if your customer is buying their first house, they will be learning about down payments and mortgage rates for the first time - as well as navigating the ups and downs of actually buying a house. Rocket Mortgage’s step-by-step guide to buying a house is a great example of how financial institutions can create financial education resources to help customers navigate major life milestones.

It’s in-depth without being overwhelming. It breaks the entire house-buying process down into smaller steps to make it easier for customers to understand. It also links out to extra resources to explain terms specific to the house-buying process, which customers may be unfamiliar with.

Finance content like this can be an evergreen resource. The processes you’re describing won’t change much, so your content will remain relevant and helpful for your customers for a long time.

Help and educate customers instead of selling to them

Your customers know their own circumstances better than you, but they _don’t _understand all the financial concepts, processes, and options that may be available to them.

Offering educational, financial content helps your customers improve their financial literacy and develops stronger relationships between your company and your customers. You become more than a financial service provider: to your customers, you position yourself as a primary resource they’ll turn to for financial information and guidance.

Backlinko’s B2B Content Marketing Report found that “educational blogs receive 52% more organic traffic than company-focused blogs.” While your customers may come straight to your website rather than via Google, it’s important to remember that they’re searching for information, not products.

For example, Regions offers a variety of financial education resources, such as this recent financial literacy webinar focused on helping their customers “learn smart money management tips to help [them] be resilient in the wake of the pandemic.”

Sharing helpful content instead of always pushing a sale shows your customers that you’re on their side. If you can become a trusted resource and advisor, your customers will feel more positive about your company and be more likely to stick with you long-term rather than switch to a competitor.

Bonus tip: Not all of the content you create has to be geared toward financial literacy education. You can also create content that enhances customer retention via a customer loyalty program.

This can be exclusive content that only those in the customer loyalty program have access to such as custom personal finance education or templates that allow them to develop a tailored emergency fund or financial goal setting that helps them get more out of their savings account while also improving their credit score.

Empower customers with educational, financial content

Your customers aren’t financial experts, but you can empower them to have confidence in their financial decision-making by improving their financial literacy with your educational content.

Short-term, this builds customer trust and confidence in your financial institution as they improve their self-confidence and tackle financial milestones in their day-to-day lives.

Long-term, you’ll see the benefits of building customer loyalty with your content, as they’re more likely to recommend your company to friends and colleagues and to stick with you as their family’s primary financial institution.